As a Chief Compliance Officer and regulator in my former life, it surprised me that technology and common standards across the industry do not play a central role in managing compliance programs. Given that all firms under one regulator have the same requirements, I expected to find but did not find providers who offered platforms to enable regulatory filings, monitoring and communication. So, I decided to take up the challenge and founded VigilantCS.

As a Chief Compliance Officer and regulator in my former life, it surprised me that technology and common standards across the industry do not play a central role in managing compliance programs. Given that all firms under one regulator have the same requirements, I expected to find but did not find providers who offered platforms to enable regulatory filings, monitoring and communication. So, I decided to take up the challenge and founded VigilantCS.

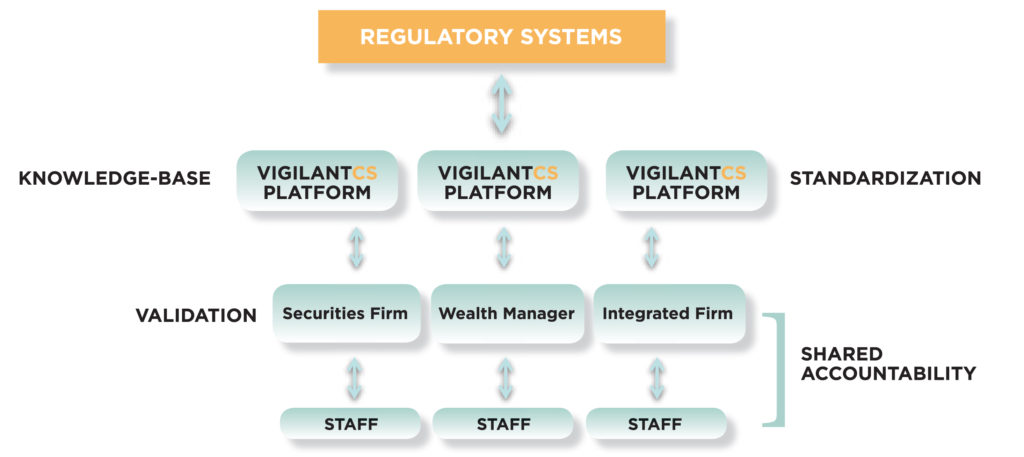

Through standardization, shared platforms provide the benefits of lower compliance costs, improved controls and best practices and risk analytics for ease of benchmarking. If certain compliance requirements are not a differentiator for a securities registrant, building a common, automated and digitized platform offers benefits across the financial services industry.

So, why has this not happened in Canada? Compliance requirements unrelated to core business activities, such as client servicing or investment management, are often not viewed as a priority. Outside of these core areas, firms tend to react to regulatory findings or simply administer compliance requirements with manually intensive processes. The outcome is unstructured data, typically on spreadsheets, which is a lost opportunity because trends and patterns cannot be easily retrieved.

Since the credit crisis, increased regulations and beefed up manual processes have added over 125,000 new compliance professionals internationally. The result? Compliance and risk management now consumes from 7% to 10% of operating budgets. With high costs and declining margins on the one hand, and relatively inexpensive flexible software on the other, we have finally hit an inflection point where Regulation as a Service (RaaS) has emerged as a new domain.

RaaS leverages a common technology platform on which compliance obligations are maintained and kept up to date by a software vendor. Through an outsourced shared platform, financial services firms save on internal IT costs, compliance and business resources. A shared platform enables firms to benefit from economies of scale and more robust risk reporting via common data standards and benchmarking. The ideal market for these services is regulatory monitoring, reporting and communication in areas such as proficiency and continuing education tracking (for regulators and accreditation bodies), staff registration and exempt distribution filings.

Leveraging RaaS has also changed the way regulators and the industry interface. FINRA (US), FCA (UK), ASIC (Australia) and MAS (Singapore) have already moved to open APIs to support RaaS and digitized integration. As the Canadian Securities Administrators move toward a new national registration system, including NRD, SEDI, SEDAR and exempt distribution, open APIs will be essential to reap the full benefits of RaaS for clients, firms and regulators—better quality data, greater transparency, reduced costs and maximum ROI on technology spend.

Founded by compliance professionals, VigilantCS provides a technology platform for the management and monitoring of staff-level compliance through the automation of regulatory requirements, digitized data and conduct risk analytics.